The prevailing view of what constitutes a „good” ratio has been changing in recent years, as more companies have looked to the future rather than just the current moment. Some lenders and investors have been looking for a 2-3 ratio, while others have said 1 to 1 is good enough. It all depends on what you’re trying to achieve as a business owner or investor. Hence, Company Y’s ability to meet its current obligations can in no way be considered worse than X’s.

Discover more from Accounting Professor.org

The cash ratio is ideal for assessing immediate liquidity without assuming future collections, but it may be too conservative for businesses that collect payments reliably, like SaaS or professional services. Your company has R500,000 in current assets, R100,000 in inventory, and R200,000 in current liabilities. The current ratio can be useful for judging companies with massive inventory back stock because that will boost their scores. On the other hand, the quick ratio will show much lower results for companies that rely heavily on inventory since that isn’t included in the calculation. A high ratio can indicate that the company is not effectively utilizing its assets.

Advanced ratios

However, if the current ratio of a company is below 1, it shows that it has more current liabilities than current assets (i.e., negative working capital). If the current ratio of a business is 1 or more, it means it has more current assets than current liabilities (i.e., positive working capital). However, an examination of the composition of current assets reveals that the total cash and debtors of Company X account for merely one-third of the total current assets. This ratio was designed to assist decision-makers when determining a firm’s ability to pay its current liabilities from its current assets. To compare the current ratio of two companies, it is necessary that both of them use the same inventory valuation method.

Why You Can Trust Finance Strategists

We’ll also explore why the current ratio is essential to investors and stakeholders, the limitations of using the current ratio, and factors to consider when analyzing a company’s current ratio. The current ratio accounts for all of a company’s assets, whereas the quick ratio only counts a company’s most liquid assets. The current liabilities of Company A and Company B are also very different.

Inventory Management Issues – Common Reasons for a Decrease in a Company’s Current Ratio

This can lead to missed opportunities for growth and potential financial difficulties down the line. The calculation method for the quick ratio is more conservative than that of the current ratio, as it excludes inventory from current assets. We’ll delve into common reasons for a decrease in a company’s current ratio, ways to improve it, and common mistakes companies make when analyzing their current ratio. However, if you look at several years’ worth of quarterly current ratios, it’s easier to see a pattern emerge. Businesses may experience fluctuations in their current ratio as a result of seasonal changes.

Companies may need to maintain higher levels of current assets in industries more sensitive to economic conditions to ensure they can weather economic downturns. The regulatory environment in the industry can affect a company’s current ratio. Companies in heavily regulated industries may need to maintain higher current assets to meet regulatory requirements. Companies may need to maintain higher current assets in a highly competitive industry to meet their short-term obligations in a downturn. A company may have a high current ratio but struggle to meet its short-term obligations if it has negative cash flow.

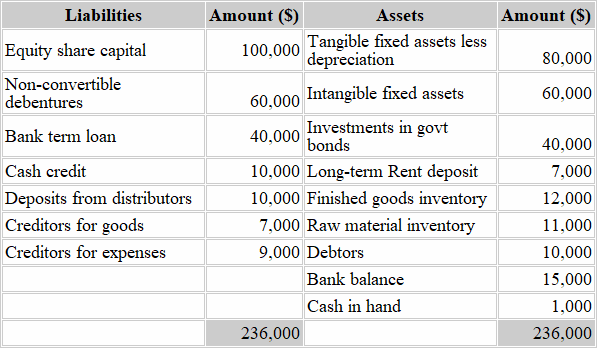

The formula to calculate the current ratio divides a company’s current assets by its current liabilities. To measure solvency, which is the ability of a business to repay long-term debt and obligations, consider the debt-to-equity ratio. It measures how much creditors have provided in financing a company compared to shareholders and is used by investors as a measure of stability. The cash ratio measures your company’s ability to cover short-term obligations using only cash and cash equivalents. The quick ratio, or “acid test,” is a financial metric that measures your business’s liquidity—your ability to meet short-term obligations using only your most liquid assets.

Therefore, the current ratio is like a financial health thermometer for businesses. It helps investors, creditors, and management assess whether a company can comfortably navigate its short-term financial waters or if it’s sailing into rough financial seas. the 8 important steps in the accounting cycle It’s a key indicator in the world of finance that’s worth keeping an eye on to make informed decisions about a company’s financial stability. When you calculate a company’s current ratio, the resulting number determines whether it’s a good investment.

Calculating the current ratio at just one point in time could indicate the company can’t cover all its current debts, but it doesn’t mean it won’t be able to once the payments are received. A current ratio that is in line with the industry average or slightly higher is generally considered acceptable. A current ratio that is lower than the industry average may indicate a higher risk of distress or default. Similarly, if a company has a very high current ratio compared to their peer group, it indicates that management may not be using their assets efficiently. This formula provides a straightforward way to gauge a company’s liquidity and its ability to meet short-term financial obligations. For example, if a company’s current assets are $80,000 and its current liabilities are $64,000, its current ratio is 125%.

- Both give a view of a company’s ability to meet its current obligations should they become due, though they do so with different time frames in mind.

- Read about features, pricing, and more to make the best decision for your company.

- By extending payment terms or negotiating discounts for early payment, a company can improve its cash flow and increase its ability to meet short-term obligations.

- As with many other financial metrics, the ideal current ratio will vary depending on the industry, operating model, and business processes of the company in question.

For example, companies in industries with high inventory turnover, such as retail, may have lower current ratios due to the high inventory value on their balance sheets. They include accounts payable, short-term loans, taxes payable, accrued expenses, and other debts a company owes to its creditors. Current liabilities are also reported on a company’s balance sheet and are typically listed in order of when they are due. In that case, it may need to increase its current assets or reduce its liabilities to improve its financial health. On the other hand, if a company has a high current ratio, it may have excess cash that could be used better, such as investing in new projects or paying down debt. As a fundamental financial metric, the current ratio is essential in assessing a company’s short-term financial health.

The current ratio and quick ratios measure a company’s financial health by comparing liquid assets to current or pressing liabilities. The current ratio provides insight into a company’s liquidity and financial health. It helps investors, creditors, and other stakeholders evaluate a company’s ability to meet its short-term financial obligations.